So you’ve found your favourite museum or gallery and you want to give them a donation. That’s great, but what happens now? How do you know if they are able to accept the donation? Will your donation be tax deductible? How do you go about donating objects to a collection?

Don’t panic because we are here to talk you through the ins and outs of donating.

For a donation to receive any tax deductibility, it must be given to an organisation that has deductible gift recipient (DGR) status. DGR status is set out in Subdivision 30-B of the Income Tax Assessment Act 1997 and lists the funds, authorities and institutions which are eligible to receive deductible gifts. Public art galleries, museums and libraries generally fall into this category.

Other cultural organisations may be listed on the Register of Cultural Organisations. To be eligible for listing on the Register the principal purpose of the organisation must be the promotion of cultural activity and they must be located in Australia.

It is worth looking up the DGR status before you donate. Just because an organisation is registered as a charity with the Australian Charities and Not-For-Profit Commission, it does not automatically mean that it has deductible gift recipient status.

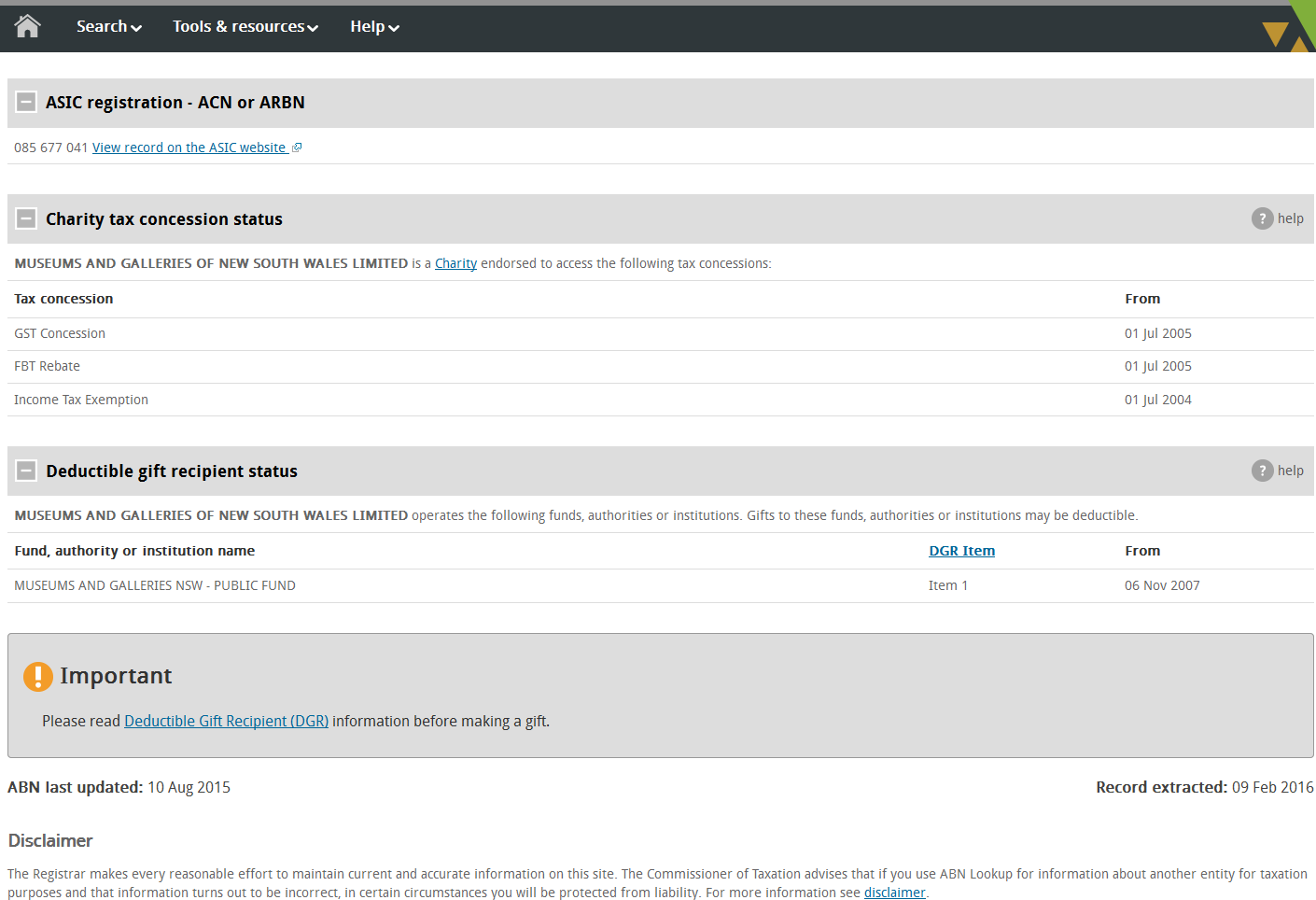

The quickest way to check an organisation’s DGR status is to look up the organisation on the Australian Business Register. You can do this by searching the organisation’s name or its Australian Business Number (ABN).

Australian Business Register

At the bottom of the page, you will be able to see whether the organisation has DGR and what kind of donations it is able to accept. The example in the image above is for M&G NSW, click to enlarge.

If the organisation does not have DGR, you can still make a donation but note that you will not be able to claim any tax deductibility.

If you are thinking of donating artwork or artefacts, it is critical to approach the organisation to determine if they will accept it. Most museums have a collection policy that covers the conditions and type of objects they are willing to accept. Organisations may impose some conditions on your donation, including the right to sell or dispose of the item at some point in the future. This is known as deaccessioning. Have a conversation with any organisation you are thinking of donating to and ask about their collection and deaccession policies.

You can also put your own conditions on your gift but this may make it less attractive.

WONDERING WHAT TO DO WITH YOUR END OF FINANCIAL YEAR DONATION?

Why not support the work of M&G NSW (all donations over $2 are tax deductible) or donate directly to your local museum or gallery.